Review the Conceptual Investment requirements to prepare for an investment or sponsorship funding opportunity.

Click to Return

Conceptual Investment readiness is a distinguishable category for worthy entrepreneurs in the Business Entrepreneur, Business Philanthropy, and Ultimate Philanthropy tracks. This is an outcome of Phase 2: Pace to Success. An entrepreneur can receive a financial investment or sponsorship funding after successful completion of the full program. An entrepreneur receives this designation when he or she has met the following conditions:

- Business is ready for conceptual or pre-seed investment or sponsorship funding

- Business has a strong team in place to operate

- Business has a clear roadmap (business plan) to achieve its stated vision and mission

- Business has demonstrated potential to achieve its stated project goal as measured by actual business outcomes and results

- Business has demonstrated potential to achieve its stated social impact goal as measured by actual social outcomes and results

- Business has demonstrated potential to operate efficiently and effectively from achieving its stated financial or revenue goal as measured by actual annual revenue, expenses, and profit*

*Denotes Business Entrepreneurs and Business Philanthropists are required to generate a profit. Ultimate Philanthropists are only required to generate revenue.

Conceptual Investment requires a MENTOR Professional or MENTOR Small Business membership in the leadership community. A candidate must complete the Conceptual Investment process to receive a financial investment or sponsorship funding.

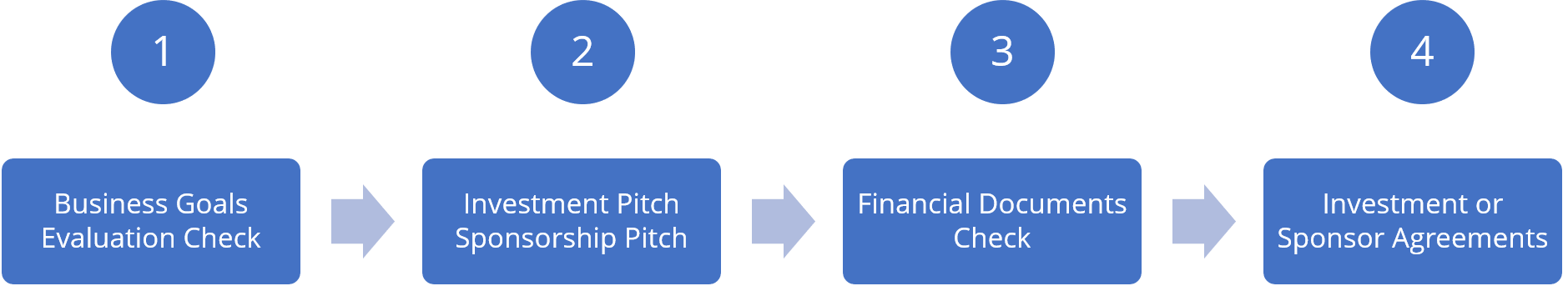

Conceptual Investment Process

The entrepreneur and his or her team must minimize any gaps in the business plan. They must ensure that appropriate single or dual operations and social impact metrics are in place to grow the business to profitability and be sustainable within the business model. A Conceptual Investment assessment requires a complete and thorough review of the categories defined and will include:

- Business Goals Evaluation Check

- Investment Pitch (deck, full plan, capital investment terms)

- Financial Documents Check (P&L, Balance Sheet, Tax Returns, Bank Statements)

- Investment or Sponsor Agreements

Note: Items 1-3 in the list above must be in place and validated by Shinshuri Foundation before item 4 and a formal financial investment or sponsorship funding transaction can be secured with the business candidate.